The loans were made through a special loan program set up by the Fed in the wake of the Bear Stearns collapse in March 2008 to keep the nation's bond markets trading normally.

The amount of cash being pumped out to the financial giants was not previously disclosed. All the loans were backed by collateral and all were paid back with a very low interest rate to the Fed -- an annual rate of between 0.5% to 3.5%.

Still, the total amount was a surprise, even to some who had followed the Fed's rescue efforts closely.

"That's a real number, even for the Fed," said FusionIQ's Barry Ritholtz, author of the book "Bailout Nation." While the fact that the markets were in trouble was already well known, he said the amount of help they needed is still surprising.

"It makes it very clear this was a very serious, very unusual situation," he said.

Sen. Bernie Sanders, the Vermont independent who had authored the provision of the financial reform law that required Wednesday's disclosure, called the data that was released incredible and jaw-dropping.

"The $700 billion Wall Street bailout turned out to be pocket change compared to trillions and trillions of dollars in near zero interest loans and other financial arrangements that the Federal Reserve doled out to every major financial institution," Sanders said.

Granted, the banks paid these loans back, but the collateral they put up to back these loans were again, worthless paper.

Tyler Durden -- and Rep. Alan Grayson -- noticed this missing $9 trillion back last year. Makes you wonder just why Grayson was successfully zapped as the "GOP's Number One Target" in the House. A whole lot of money from outside Orlando went into that race to get a win for Daniel Webster. Here's what the banks got, by the way:

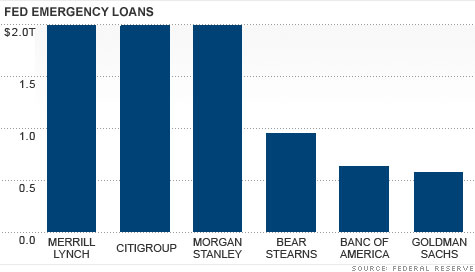

Some two trillion a piece for Merill, Citigroup, and Morgan. Nearly one trillion in a losing effort to save Bear Stearns. The Fed was the only liquidity game in town on the bond side for months. And in return, what did the taxpayer get?

Record profits for banks.

Now you know why. While America was worried about the stimulus bill, the real show was going on behind the scenes at the Fed. The only reason we even have these major banks is due to these near zero-interest loans based on worthless collateral. Nine trillion bucks worth. And these guys think they deserve bonuses this year, while the rest of us are told we must tighten our belts.

That's fair, right? Washington seems to think so. Both parties. Any who object, well, ask Alan Grayson what happens.

1 comment:

Nine trillion dollars. And now we're getting fraud charges. Lovely. Money well spent, I'd say.

Although, do be fair, it did save the economy from worse, but we still should have been beating the bankers over this.

Post a Comment